A study conducted by marketing communications agency HaveYouHeard has found that South Africans want brands to stay being active in their lives by advertising during lockdown.

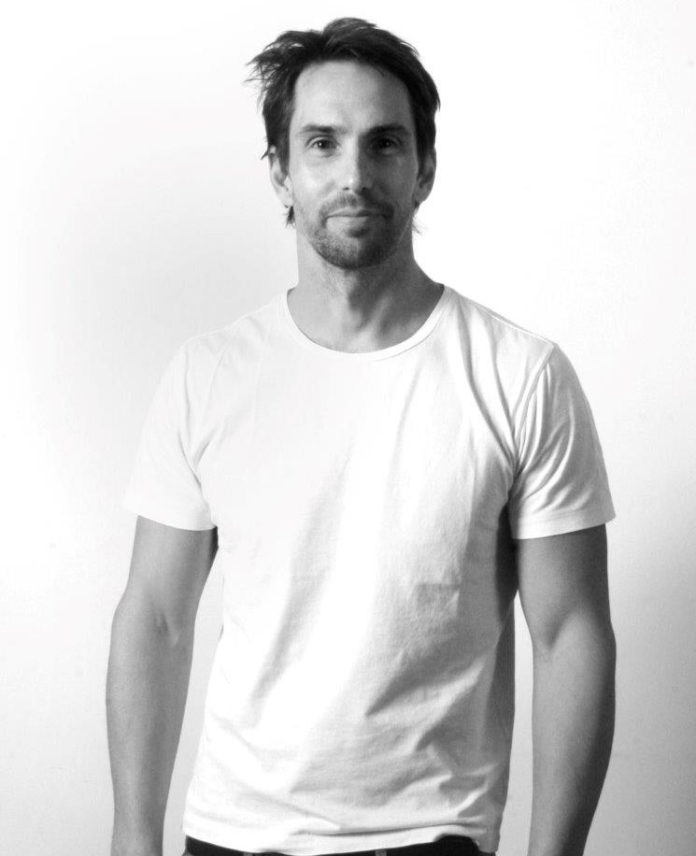

According to the agency’s Head of Strategy, Ryan McFadyen, the overall expectation of the 780 respondents to the survey is that brands should be active and should be useful, whether to them, the actual consumer, or the general public by large. In fact, 37% spontaneously stated they wanted brands to continue advertising or being active in their lives while only 8% felt the other way.

“More respondents were in favour of brands being in their lives than keeping quiet. They added that this communication should shift to those channels where they’re spending more time – for some this was in the traditional media but, for many more, it was social and online media.

“Those who said brands should not be advertising suggested marketing or advertising budgets should be spent helping consumers either through cheaper product offerings or by launching programmes that support South Africans’ efforts to remain safe from infection,” McFadyen said.

The study also highlighted that consumers are holding brands to the highest possible standards during the pandemic. Maybe more so than what is financially possible; but consumers do expect these brands to behave with a responsible ‘humanity first’ approach.

Some consumers spoke of brands first protecting their own staff and saving jobs within their companies, being transparent and clear in how they have been impacted and explaining measures they would be taking, McFadyen added.

Here, many respondents spontaneously mentioned which brands they felt were behaving responsibly. The 14 brands with the most spontaneous mentions were Pick n Pay, Woolworths, Checkers, Spar, Shoprite, Nando’s, Dettol, Vodacom, Dischem, Lifebuoy, Coca-Cola, Old Mutual, Tiger Brands and Discovery.

McFadyen stressed that the pandemic and the measures put in place to curb its spread, such as lockdown, are already influencing consumer behaviour and perceptions. This will have a profound impact on how brands behave post-COVID-19, he said.

“Consumers have had to alter their lifestyle, change their behaviours and find new ways to purchase. They have been pushed into a zone of experimentation based on new ‘need-and-want’ parameter and these changes are impacting how consumers are benchmarking value. It is still unclear if this will create permanent change, or a fast swing back to old norms, or something in the middle, but what is clear is that brand choice is undergoing forced shifts.

Half of consumers are spending less money, both because they have fewer opportunities to spend as well as the need to save money due to reduced income. However, the lower income levels had to spend more money at the start of lockdown, with the majority of this spend being on food groceries (88%), household essentials (59%), medical supplies (33%) and entertainment/internet (32%).

People need people, and have a desire to belong which is an important role of any brand. But lockdown, face masks and social distancing are all limiting social connection and are creating an opportunity for social intimacy to be fostered within the constraints of the law. How brands provide spaces or ways for people to come together and to belong will be important.

Further, ‘Corona Fatigue’ is starting to set in and it is very difficult to escape. This therefore will become a big driver for consumers and they will look for brands who can facilitate escaping the overwhelming stress and threat of COVID-19 to being able to think, do, believe and engage with what life used to be, what life could be or what life would never be.

McFadyen’s advice for brand owners is that it is more critical than ever for brands to have a very clear understanding of the role they play within their consumer’s lives. As such, he said should develop clear answers to 4 critical questions:

- As a brand, what do we believe gives us a distinctive viewpoint about the world and our place therein?

- What do we sell? Clearly articulated and simple to understand.

- What do we do? Our role within the world, linked to our product and the needs of our audience.

- How do we do it? In a way that is authentic to our distinctive viewpoint and done in a way in which only we could do it.

“Brands need to gain a clear understanding of their audience. The COVID-19 crisis will inevitably change the world in which we function and so the insights around your audience prior to the pandemic will have changed significantly. Efforts spent to uncover these insights will be invaluable as a simple insight may be the difference between success or failure”.

“Consumers don’t want to be a part of your story; you need to become a part of theirs. Build work that matters, is authentic to the brand and that creates real world impact in order to reap long-term rewards,” he said.

To see a full copy of the report, please click here.

Examples of respondents’ quotes with respect to brands:

- “The worth of the brand for me is determined in terms of their social responsibility. Brands depend on consumers and it is time that they showed their civic responsibilities.”

- “Assist where they can, behave in the best Interests of the communities that have supported them over all the years.”

- “Profiteering at a time like this is like shooting fish in a barrel. We all need to get through this in one piece, and that also applies to our finances.”

- “I definitely think advertising has to stay up to date with the latest. developments as they happen. This isn’t the time for advertising creams to make you look younger. It is the time to educate people who aren’t getting educated because of their lack of knowledge of how to use online learning. Perhaps advertising should be geared towards teaching this.”

- “I feel brands should be aware of the severity of the issue, while not overtly leveraging coronavirus for financial gain. Respond with solutions to the world’s new problems. Put their money where their mouths are and work to make a positive impact wherever possible.”

- “Show real appreciation of the impact this is having. Price reductions, ways to practically help customers. No more ‘we have your back’, mass mailed, insincere letters – they are meaningless.”

- “I hate the way brands have responded to this. Whilst I know there is a place for business to evolve during a trying time, more companies are capitalizing off of this than anything. They have lost their sense of purpose. So, I believe brands should be thinking more about the communication they are sending out there as opposed to being so reactive.”

- “Brands should come together to assist people in need, whether it is food or musical and art platforms, online lessons etc. Right now is the time we need to work together because every single person is affected.”

- “A large percentage need to focus on the role they can play in people’s lives and not get too caught up in trying to have a purpose relevant to COVID-19.”

- “Brands should be sensitive to the current times and focus on delivering light-hearted and highly-targeted content [not ads] to build meaningful connections with their consumers.”

- “I think food brands should realise that everyone is cooking so much more home-food for the family (no quick packed sarmies for lunch!) so they can maybe suggest 10-minute meals using their products. I think food brands can highlight their immune-boosting ingredients. Brands can offer bulk specials and emphasise how it will cut down on grocery store visits.”

- “Now is the time to win new customers, provided you provide solid value. We have seen there are other means of sourcing goods and products. You need to become even more convenient and improve your value offer.”

Other key findings from the first survey include:

- The government was seen to have performed their role very well and ensured that the majority of South Africans were largely in agreement with the Lockdown measures. Only 10% feel that the Government’s response is lacking and 16% felt that it was too late, driven by lower income respondents. There is unity across the board on the acceptance of this due to the severity of COVID-19, (although this sentiment has likely shifted in the past weeks).

- A third of individuals with a monthly household income less than R5 000 a month believe contracting Coronavirus will no longer be a problem by July 2020. The majority of respondents agree that it will be much longer.

- Concerns around income loss/retrenchments and the economy are currently more top of mind than the spread of the virus. During lockdown the direct consequences of these financial losses were immediately felt by many South Africans, as well as indirect consequences such as increased inequality, hunger, homelessness, violence, crime and civil unrest. A health pandemic of this nature hasn’t been experienced by this generation and is difficult to imagine. The impact on loss of life was not felt at the time of lockdown by many.

- The majority of South Africans believe this pandemic will have a negative impact on South Africa’s future, while still feeling more optimistic about their own.

- The long-term positive impact is likely to be increased social cohesion, empathy and respect for frontline workers. Some are forced or are choosing to reevaluate and reinvent themselves. Trust in Government’s capability has improved with a need to adapt and fix the inequality and problems South Africa faces.

- Half of consumers are spending less money, both because they have fewer opportunities to spend and reduced income. This is skewed towards upper income brackets.

- However, many people with lower household incomes had to spend more money at the start of lockdown, with the majority of this spend being on food groceries and household essentials.

- The majority of people are baking and cooking more, but this is contrasted with many people who are going without food and struggling to pay rent. Cleaning, spending time with family and creativity has increased while people are limited to the confines of their homes.

780 respondents were recruited through HaveYouHeard’s existing consumer panel, influencer network and through Facebook and WhatsApp. This sample included seven different household income groups from those earning less than R5000 a month (27%) to those earning more than R50 000 a month (12%). Fieldwork was conducted between March 26 to April 28.