South Africa’s GDP growth for 2017 was rather optimistically projected by treasury to reach 1.3. We’re currently sitting on 0.7% GDP growth for 2017, on par with Brazil and Belarus. Brazil is recovering from a recession and faces political uncertainty, while Belarus has a population that’s a sixth of the size of South Africa. South Africa’s flirtation with balance and nonchalant political stability is worrying as expanded unemployment, which includes discouraged workers, reaches 36.6%

Consumers face increased affordability pressure and this is expected to continue and perhaps even worsen if the county remains risky ground for foreign investment. Although the income servicing debt has improved over the years, it still remains high.

The full retail landscape has growing diversity of local start up brands and international powerhouses entering the market. Shoppers have options and overwhelming choice. They are responding by being more careful with purchases and therefore making considered choices.

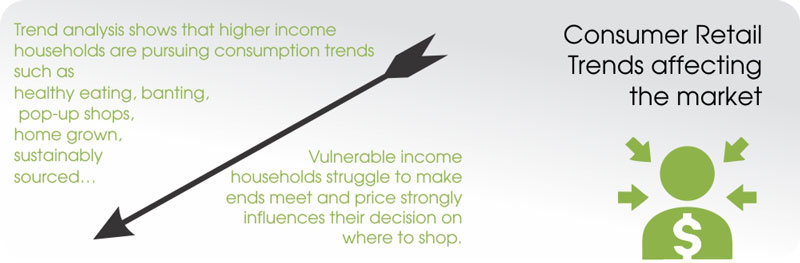

Grocery retailers experience the most immediate impact, and competition to differentiate their appeal to shoppers, is so quick it sometimes seems experimental. The general retail index shrunk 27% since its April 2015 high, however 2 retailers are swimming strong against the current. Clicks and Dis-Chem have both achieved double digit stock gains. This is due to consumer trends and store expansion. Trend analysis shows that higher income households are pursuing consumption trends such as healthy eating, banting, pop-up shops, home grown, sustainably sourced…

These movements see loyalty, new entrants and growth. During 2016 retailers increased their product offering and expanded into new segments while pushing price competitiveness. Vulnerable income households struggle to make ends meet and price strongly influences their decision on where to shop.

A silly season won’t pass by without Christmas advertising and somewhat of a buying frenzy… People will chose to spend on essentials like housing, electricity, education, health and groceries, then reduce debt and lastly spend on leisure items. Retailers have also curtailed money invested in advertising during the Christmas season as the buying power of engaged shoppers willing and able to spend has shrunk.

In exploring how shoppers are engaging with online platforms verses brick and mortar, The Deloite SA holiday shopping trends report, found that “In 2015, over 80% of South African respondents intended to purchase from brick-and-mortar stores.” Online sales are on a steady growth trajectory but remains a small value contributor to retail sales. Part of the favoured shopping experience is to tangibly engage with the product when purchasing. This view is more relevant to the type of product being shopped for. Shoppers are also doing fewer trips to retail outlets but spending more. This behaviour is in line with using resources more effectively to extract the best possible value.

Here are the top 3 things we can expect to see this silly season:

Shoppers will continue to draw back on gifting and utilise more effective ways of purchasing, like saving a trip to the mall by ordering online or making fewer shopping trips and spending more. Online sales are forecasted to grow by 15,5% this quarter, as noted in a report by Kantar (5).

Retailers will advertise affordable value like Makro’s inflation buster promotion on gifting this Christmas. Surprisingly Makro is the only retailer from the top 5 brick and motar outlets to post a digital Christmas advert, indicating that the rest might be relying on traditional print advertising closer to Christmas to get a more impulsive buying frenzy. The challenge with a buying frenzy is that it is highly supported by price.

People are spending less and less each year on leisure items, like holiday’s and cars. This budget is being redirected to maintaining the current essential household demands, lifestyle events and experiences and lowering debt. On the lifestyle trend, we see a growing desire for health, beauty and fitness/wellness.

Despite the moderate outlook the silly season does see an upswing in consumer spending as society wants to participate in the season to ride the reindeer of positivity and hope.

Eben Esterhuizen, General Manager, OnShelf Pharma

References:

http://blog.penquin.co.za/blog/south-african-marketing-trends-for-2017

http://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD/ZAF>

https://www.cover.co.za/deloitte-sa-holiday-shopping-trends-2016/

http://www.treasury.gov.za/documents/national%20budget/2017/review/Chapter%202.pdf

http://us.kantar.com/business/retail/2017/holiday-shopping-forecast-2017/

http://www.bizcommunity.com/Article/196/168/168853.html#edscolumn

OnShelf Pharma’s foundation is built by an FMCG specialist and has a culture of tenacity with a smart solution oriented approach. The business has achieved phenomenal growth to become the preferred healthcare sales agency in the healthcare sector.