The relationship between consumers and brands have never been more complex. We have never had more data available, yet we see a decline in both customer experience and brand commitment. Consumers are overwhelmed, and are becoming extremists, self-orientated, demanding and tech-savvy.

The way that consumers interact and engage with brands is fundamentally different from five years ago. Consumers now traverse the physical and digital worlds and live in a fluid world. They are used to switching between these dual realities, and there is an increased tendency to switch between brands. Consumers are extending their brand repertoires and there is less solus usage (where consumers use only one brand within a product category). There are, however, certain brands that South Africans across the board continue to love and stick to.

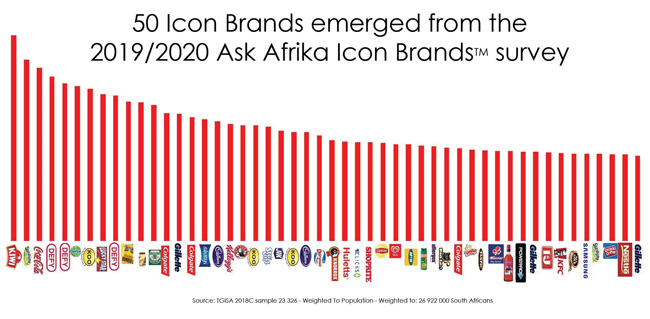

The Ask Afrika Icon Brands is the largest annual benchmark survey of its kind and, now in its 10th year, measures loyalty across 237 brand categories and thousands of brands. Despite the challenging consumer landscape, 50 brands achieved Icon Brand status in the 2019/20 Ask Afrika Icon Brands, with 12 new brands entering the prestigious ranking.

The 2019/20 Ask Afrika Icon Brands winners were recently announced, Kiwi shoe polish secured first place, followed by Sunlight dishwashing liquid, Coca-Cola, Defy stoves, Defy ovens, Dettol liquid antiseptic, Koo tinned beans, Lucky Star tinned fish, Defy hobs and Mageu No. 1. Over time most of these brands have consistently managed churn effectively and remained in South African consumers’ repertoire of usage. Defy is a newcomer in the top rankings this year.

Ask Afrika’s Icon Brands is about local relevance and brands that almost all South Africans always or mostly use – the survey measures solus usage. Icon Brands always from part of the repertoire of brands consumers buy from. The survey looks at current consumer behaviour and usage, and this is what differentiates it from other brand surveys.

The Icon Brands survey is the holy grail for brand owners as it measures brands that consumers buy and use on a regular basis. This is the most difficult to achieve, compared to brand footprint, affinity, or brands that consumers claim to love.

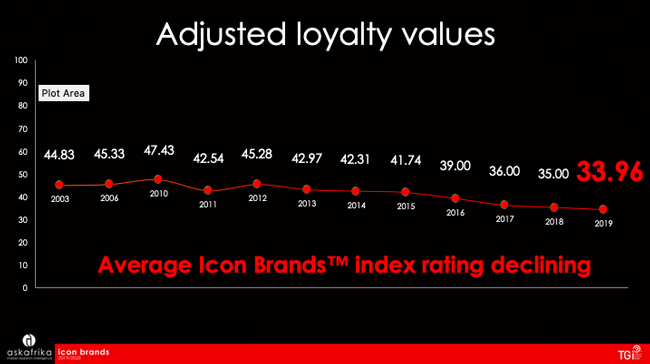

Achieving Icon Brand status is the highest accolade – the Target Group Index (TGI) database that is used in the survey measures 8 000 brands, and only 50 made the grade. Considering brand loyalty levels have been on a downward trajectory for the past 11 years, this is even more impressive.

Product category boundaries are blurring. Consumers expect the best from one category to apply across their brand repertoire. This means that brands are competing within and across numerous categories.

Marketers have to start asking different questions to understand how to get the consumer to choose a brand over and over again. This requires significant investment in the right type of data and technology; far more sophisticated marketing campaigns, brand strategies and architecture; and a complete rethink of measurements we apply.

There is more easily accessible data than ever before, but data volume doesn’t always enable granular understanding. If we are measuring everything it means that we are not using data strategically. We need to ask tough questions about where the consumer fits into the business. The future belongs to agile brands, those that can reinvent. It’s about creativity and relevance in a world we don’t yet know.

Through this annual benchmark research, we have the ability to provide strategic insight into the role that mass social consciousness trends play in shaping the expectations of consumers during their purchase decisions. These insights inform advertising and marketing campaigns to focus on key brand personality traits that consumers connect with.

Topline trends from the Ask Afrika Icon Brands survey

Is loyalty still relevant?

Consumer behaviour cannot be understood in isolation and needs to be contextualised within the landscape of global and local realities and lifestyle trends. Loyalty levels are declining in all spheres of life and brand owners need to question whether it is realistic to continue expecting consumers to remain loyal to their brand when they are not loyal to anything else, including religion, politics, work or relationships.

An overwhelmed society and the impact of technology

Brands are widening their scope to gain market share and it seems that every brand is targeting almost every consumer. This leads to consumers feeling overwhelmed and like they’re targets. The extreme brand personalities stand out. There is an increased awareness among consumers of manipulative brand strategies, even though they endorse or are complicit in co-creating this cycle of manipulation.

The line between enticement and addiction is blurred. We have become addicted to efficiency-driven lifestyles – which transcends instant gratification. We expect everything to be frictionless: experiences should be meshed into our lifestyles and everything we consume – from food to technology and apps – to allow us to dedicate more time to our professional and social lives.

Technology has a huge impact on consumers and South Africans spend a significant portion of their time online. We have a compulsion to share everything on digital media.

In essence, this has resulted in jumping jack engagement, where we jump from one exciting or dramatic discourse to the next, from one fad to another. It creates a breeding ground for dysfunctional behaviour and extremist behaviour in an extremist society. There is an endless need for more, and a sense of crave-ability or stickiness that makes it hard to exit the happy kingdom of consumerism. This will be the year that consumers seek to find balance in a world that is rapidly tilting out of control.

Obsession with self and the rise of individualism

The general consumer sentiment is that: “Everything and everyone wants more from me and I want more from them. I know more, I expect more and I judge more. I’m significantly more informed. I desire authenticity on my own terms. It is supposed to be all about me.”

This obsession with self is reflected by a shift in the types of brands and products that are now securing Icon Brand status and the ones that are falling off this list. Consumers are increasingly spending money on themselves.

There is a trend towards the collapse of collectivism and the rise of individualism, which implies that successful brands will be those that relate to consumers on a granular level. Brands that move beyond transactional engagement to experiential retailing and truly engage with consumers on a psychological and emotional level will stand the test of time.

What is happening in the world today is no ordinary disruption. We have developed complicated relationships with retailers, brands and loyalty programmes, and this has resulted in layered fragmentation.

Consumers are price sensitive

Nonetheless, price remains a driving factor in consumer choice, and promotions, loyalty programmes and benefits from a variety of retailers come into play. Consumers are price sensitive and this has become a key influencer in an environment in which they have a wealth of choice. Young people are no longer absolute luxury shoppers; they mix and match the high with the low to express their personal style.

Sustainability and a regenerative reality

Another trend this year, driven by younger generations, is an increased focus on sustainability – the loyal consumer market has a high percentage of engaged green consumers. These consumers are willing to make changes in their personal lifestyles, but expect the same from the brands they use. They are breaking away from stereotypes into a more fluid sense of identity.

We are moving towards a regenerative reality in which people are taking action to improve the world in which we live. Social capital is an important factor in driving consumer behaviour: 87% of consumers surveyed said they’d purchase a product because a company was advocating for an issue they cared about; 75% would refuse to purchase a product if they found out a company supported an issue contrary to their beliefs; and 86% of consumers want brands to take a stand on social issues. There has been a trend to support local brands for some years and this continues in 2019.

Unpacking the robust methodology and reporting

The Ask Afrika Icon Brands survey uses the TGI database, for which Ask Afrika has the local licence. The survey uses a nationally representative random sample – 23 346 consumers were surveyed, representing 26 922 000 adult South African consumers. An enumerated area sampling design was employed, and the universe includes all communities with more than 8 000 inhabitants 15 years old and above. The data was weighted using Statistics South Africa’s mid-year population estimates and audited by respected independent experts BDO and Dr Ariane Neethling.

Ask Afrika Icon Brands reports can be tailored to include an overall trends report; total market analysis; identification of loyal and less loyal segments; target market segmentation and profiling; brand and strategy development; consultative workshops; and/or data fusion.

For more information or to order a report, contact Maria Petousis, Maria.Petousis@askafrika.co.za, or dial 012 428 7400.

About the Ask Afrika Group

Ask Afrika is a full-service market research company. With over 24 years’ experience, we partner with clients in the financial services, retail, telecoms, automotive and public sectors for customised research. We work across Africa, which makes us a great partner for multinational companies.

Ask Afrika is a specialist in customer service research. Besides having the most extensive proprietary benchmarks, Ask Afrika is also the preferred partner for government and NGOs seeking proactive social research.

The Target Group Index (TGI) survey has a global geographic coverage of 70 markets and measures service, products, media and brands.

Ask Afrika’s knowledge of brands is extensive and TGI is already used by the majority of the top 50 advertisers and media owners in South Africa. TGI complements local and global measurement currencies, and offers the most comprehensive insights into consumer demographics, behaviour, and product and brand usage, with rich attitudinal statements.

The Ask Afrika Group’s exclusive product suite includes the Ask Afrika Orange Index®, the Target Group Index (TGI), Ask Afrika Icon Brands™ and Ask Afrika Kasi Star Brands.

With us, you can make game-changing business decisions confidently.

Website: www.askafrika.co.za