The top brands in South Africa’s townships were revealed in a Daily Sun supplement on 16 May 2017. Market research company, Ask Afrika, conducted a comprehensive nationwide survey with a sample that is representative of the township population comparing brand usage across 144 product categories and ranking 2 996 brands. This year 36 Ask Afrika Kasi Star Brands and 59 potential Kasi Star Brands emerged from the study. Kasi Star Brands are woven into the fabric of vibrant South African townships.

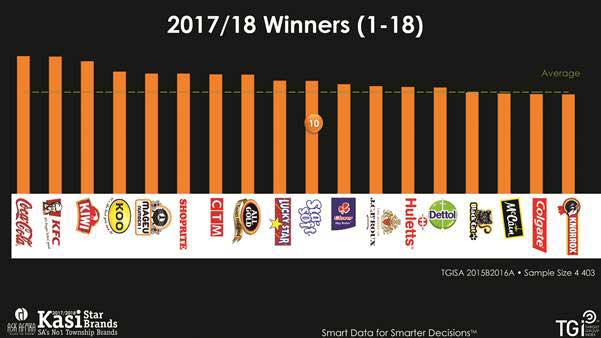

The overall 2017/2018 Kasi Star Brands winner and favourite township brand is Coca Cola, with KFC in second place, Kiwi shoe polish third, Koo beans fourth and Mageu No 1 fifth. Coca Cola has been the top township brand for two years running.

Ask Afrika Kasi Star Brands are defined as brands that are used most loyally by South African township consumers. These brands encapsulate a common experience and Kasi consumers are committed to them. The Ask Afrika Kasi Star Brands benchmark is a powerful tool for brand owners to measure return on investment (ROI) in the township market.

The 36 Ask Afrika Kasi Star Brands 2017/2018

Rank

| Kasi Star Brands | Category Name | |

| 1 | Coca Cola | Non-Alcoholic Cold Drinks: Colas And Other Fizzy Drinks |

| 2 | KFC | Fastfood Outlets |

| 3 | Kiwi | Shoe Polish |

| 4 | Koo (Beans) | Tinned Beans/Vegetables |

| 5 | Mageu No 1 | Milk: Mageu/Maheu |

| 6 | Shoprite | Food Retail (Supermarket) |

| 7 | CTM | Tile Retail Stores |

| 8 | All Gold | Condiments And Sauces: Tomato Sauce |

| 9 | Lucky Star | Tinned Fish |

| 10 | Sta-Soft | Fabric Softners |

| 11 | Clover | Milk: Fresh |

| 12 | JC Le Roux | Wine Sparkling |

| 13 | Huletts (Sugar) | Sugar & Sweeteners |

| 14 | Dettol | Liquid Antiseptics |

| 15 | Black Cat | Spreads (Peanut Butter, Jam, Savoury and Sweet Spreads, Syrup, Honey) |

| 16 | McCain | Frozen Chips and Potato Products |

| 17 | Colgate | Toothpaste (Normal) |

| 18 | Knorrox | Stock Cubes |

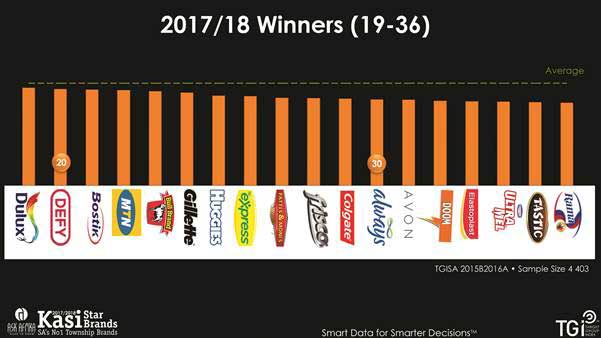

| 19 | Dulux | Paint |

| 20 | Defy (Stove) | Stoves / Ovens / Hobs |

| 21 | Bostik | Adhesives |

| 22 | MTN | Telecommunications ( Cell Main Network Provider ) |

| 23 | Bull Brand | Tinned Meat |

| 24 | Gillette | Razors (Male) |

| 25 | Huggies | Nappies |

| 26 | BP (Express) | Garage Convenience Shops |

| 27 | Fatti’s and Moni’s | Pasta |

| 28 | Frisco | Hot Drinks: Instant Coffee |

| 29 | Colgate | Toothbrushes: Manual |

| 30 | Always (Pads/Towels) | Female Sanitary Products |

| 31 | Avon | Eye Make-Up |

| 32 | Doom | Insecticides / Insect Repellents |

| 33 | Elastoplast | Medicine: Sticking Plaster |

| 34 | Ultra Mel | Custard |

| 35 | Tastic | Rice (Rice And Couscous) |

| 36 | Rama |

Margarine / Butter |

Methodology Three criteria were used to define a Kasi consumer in 2017/2018: he or she has to live in a South African township, fall into the socio-economic level (SEL) 3-5 and not have a post-graduate qualification. This is aligned with Sandeep Mahajan’s definition of a “regular township resident” and excludes the more affluent consumers that make townships their homes. All nine provinces were included in the sample of 4,403 Kasi consumers interviewed, representing the view of 9.3 million Kasi consumers across South Africa. The results were independently audited by BDO and Dr Arianne Neethling and verified by township market expert, GG Alcock. What drives brand loyalty in the Kasi? Nothing for mahala, siyazama zama (nothing is free so we make a plan). The Kasi market largely remains a price sensitive market. Kasi consumers are excellent with budgets and they are receptive to special offers. They live in an unreliable and in many cases an unsafe environment, an investment in high quality brands provides a sense of reliability and assurance to the Kasi household. The top line trends of the Ask Afrika Kasi Star Brands survey reveal a number of loyalty drivers that brand owners and marketers should bear in mind when targeting this market. Brands are a ‘cheap price’ for aspiration “I know where every cent goes, every cent is put to a cost, the money is like water through my hands, it touches them then it washes off someone else’s hands.” (GG Alcock 2015: 138) Kasi consumers, on the whole, spend money more carefully than they used to and say that it is worth spending more money for quality goods. The Kasi shoppers always look out for special offers, but if they like a product they will buy it regardless of price. They are open to trying new brands to see if they like the product, but once they find a brand that they like, they tend to stick to it. Kasi consumers will, however, try out a different brand if it is on special offer. An investment in brands is seen as a ‘cheap price’ for aspiration. It is important for Kasi consumers that they care for themselves and the people in their household by giving them the best their money can buy. “Kasi consumers expect quality and usually have a brand repertoire within their loyalty spectrum which they will compare in terms of price points and special offers. They understand the advantage of choice and will choose the best their money can buy. If a brand consistently delivers quality at the right price point, it will be used by Kasi households,” says Dr Amelia Richards, Account Director at Ask Afrika.

Proudly South African

Coca Cola the international giant is continuing to enable a customised approach for their brand. The ability of a global brand such as Coke to merge local vernacular with a personal intimate occasion between two potential lovers, is the ideal recipe for loyal consumption of Coca Cola to celebrate special moments.

Kasi consumers are proudly South African and opt to buy goods that are produced locally, believing that South African products are usually of high quality. They think that it is important that brands act ethically and refuse to buy products from a company that they disapprove of. Kasi consumers support brands that empower previously disadvantaged South Africans.

“The Target Group Index (TGI) data has shown that Kasi consumers are very loyal to South African heritage. Tradition and community is important in the Kasi where people take care of one other. They expect the same from brands that they pay money for,” says Richards, “There is a misconception amongst those that don’t know the market that when Kasi consumers become more affluent they become westernised.”

According to GG Alcock this is not the case, greater affluence does contribute to modernisation, yet township residents often stay close to their cultural and local South African heritage – they become Afropolitan. Brands that want to be successful in this space must first understand the culture and then contribute towards it in a meaningful way.

Never underestimate the Kasi consumer

“eKasi was once a swear word, a place to be feared, but is now a place where life is shared with brands and people that inspire hope, celebrate a multitude of entrepreneurs, community leaders, responsible proactive citizens of both the Kasi and the Emalalini, the rural villages.” (GG Alcock 2015)

Living and doing business in African market places require an ethos and connection to the informal, invisible and intangible. It is vital that marketers targeting this market have an in-depth understanding of this continually changing environment and lifestyle. It is important to talk to aspiration, yet to remain within reach. Many Kasi consumers travel into the cities for work and see the way that brands are being advertised there. It is vital not to denigrate the Kasi consumer through inconsistent brand messaging and tone of voice in cities versus townships.

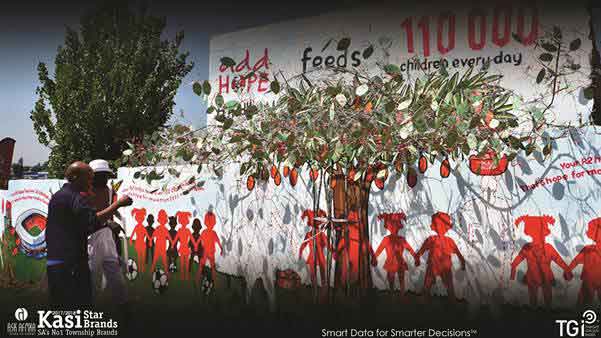

Sharing and CSI

Brands that share what they achieve in empowering and uplifting disadvantaged communities through their CSI initiatives will garner loyalty from the Kasi consumer.

Not only did the KFC “Add Hope” campaign feed 5 million children during World Hunger month, but it feeds 110 000 children every day. In 2016 the KFC initiative included the unveiling of the wall mural on Vilakazi street in Soweto, increasing awareness for the campaign. The residents can collect seeds from the tree mural on the wall encouraging them to grow their own vegetables and fruit.

“Brands that connect and identify with the language, the culture and local style will win over the hearts of Kasi consumers. Respect is inherent in the Kasi culture as are ethics, caring for the past and present, hope and a belief that we will all build a better future, as a collective – brands are expected to be part of this ethos,” concludes Richards.

Research reports

In-depth Ask Afrika Kasi Star Brands research reports assist with brand planning and marketing strategies, competitive intelligence, consumer profiling, product enhancement and client pitches. There are various reporting options that look at what is driving loyalty in the township market or which are tailored to media and marketing strategies that target the township consumer.

To find out more or to order Ask Afrika Kasi Star Brands research reports contact: (012) 428 7400 and speak to Dr Amelia Richards (amelia.richards@askafrika.co.za ) or Mariëtte Croukamp (Mariette.Croukamp@askafrika.co.za ).

About the Ask Afrika Group:

Ask Afrika Group is the largest independent South African market research company. The company focuses on local relevance, benchmarked against the global context, and is also a member of European, Market Research Organisation (ESOMAR). Apart from its South African footprint, Ask Afrika Group also operates in a dozen other African countries.

Ask Afrika Group is well known for delivering strategic and large-scale field projects and for creating benchmarks for industry.

Target Group Index (TGI) research, for which Ask Afrika Group owns the South African copyright, has an annual single source sample of 15 000 locally and 800 000 globally. It has a global geographic coverage of 70 markets, and measures services, products, media, and brands. Ask Afrika’s knowledge of brands is extensive and TGI is already used by the majority of Top 50 advertisers and media owners in South Africa. TGI complements local and global currencies. It has various integrated software modules and offers the most comprehensive insights into demographics, behaviour, product and brand use and attitudes.

The Ask Afrika Groups’ exclusive product suite includes the Ask Afrika Orange Index®, the Trust Barometer™, TGI, Ask Afrika ICON Brands™ and Ask Afrika Kasi Star Brands, the Digital Barometer and Gateway. Ask Afrika is known for its exceptional service delivery and innovation.

Website: www.askafrika.co.za